Introduction

Cryptocurrency……….! The digital asset class that took the world by storm, has become a popular avenue for investment. With the surge in popularity, US citizens are increasingly curious about how to capitalize on this exciting financial opportunity. However, before diving headlong into the world of cryptocurrencies, it’s essential to have a well-informed and strategic approach. This comprehensive guide aims to provide US citizens with a detailed cryptocurrency investment strategy, backed by trending searches on Google by Americans.

Understanding Cryptocurrency Basics

Before crafting a solid investment strategy, it’s crucial to grasp the fundamental concepts of cryptocurrencies. Cryptocurrencies are decentralized digital currencies that utilize blockchain technology to secure transactions and control the creation of new units. Bitcoin, Ethereum, and Ripple are some of the well-known cryptocurrencies that have captured the public’s imagination. As more cryptocurrencies emerge, it’s essential to conduct thorough research on each to identify potential investment opportunities.

Research and Due Diligence

As the cryptocurrency market is highly volatile and constantly evolving, thorough research is imperative. Utilize reputable sources, read whitepapers, and analyze the underlying technology and team behind each cryptocurrency. Understand the purpose and real-world applications of the cryptocurrency, as well as its potential for mass adoption. Analyze historical price charts to identify trends and patterns that can guide your investment decisions.

Diversification: The Key to Risk Mitigation

In the ever-changing cryptocurrency market, diversification is the cornerstone of a robust investment strategy. Avoid putting all your funds into a single cryptocurrency, as this exposes you to unnecessary risk. Instead, diversify your investment across multiple cryptocurrencies with different use cases and risk profiles. This strategy can help mitigate potential losses while capitalizing on the growth of various digital assets.

investopedia images

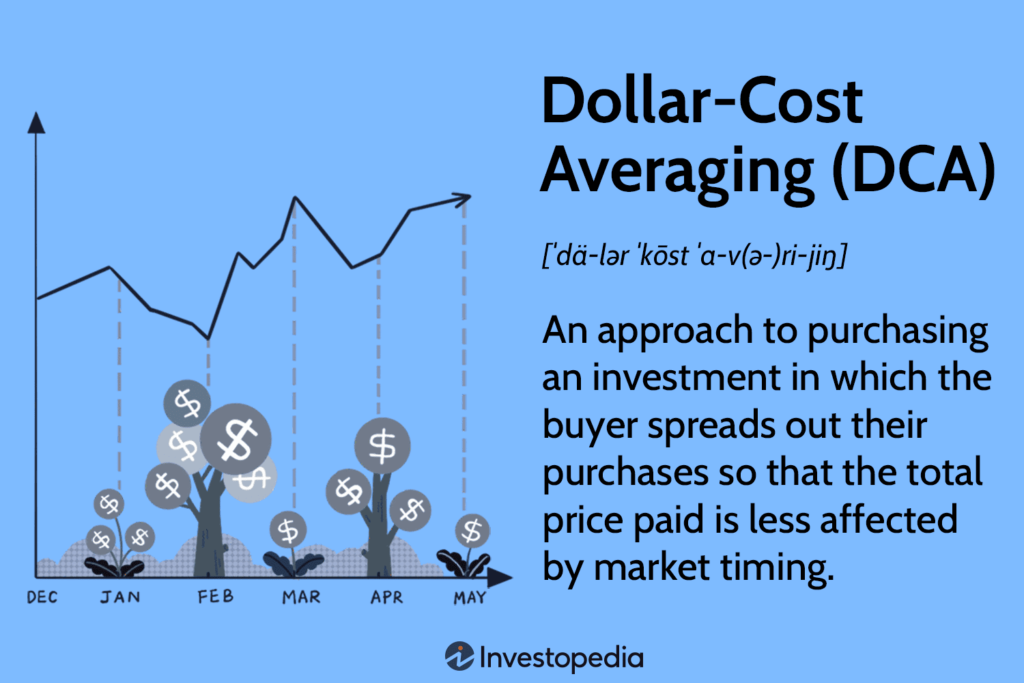

The Role of Dollar-Cost Averaging

In a volatile market, timing the perfect entry point can be challenging. Dollar-cost averaging (DCA) offers a solution by spreading out your investment over regular intervals, regardless of market fluctuations. By purchasing fixed dollar amounts of cryptocurrencies at predetermined time intervals, you can reduce the impact of short-term price volatility and benefit from long-term growth.

Security: Safeguarding Your Investments

Cryptocurrency security is of paramount importance, given the prevalence of cyber threats. Utilize reputable and secure cryptocurrency exchanges to buy, sell, and store your digital assets. Implement two-factor authentication (2FA) and opt for hardware wallets or cold storage solutions for added security. Stay vigilant against phishing attempts and never share your private keys or sensitive information.

Staying Updated with Market Trends

To make informed investment decisions, staying updated with market trends and the latest news is essential. Follow reputable cryptocurrency news platforms, join online communities, and engage in discussions to gain insights from experienced investors. Be cautious of market noise and seek credible sources that provide objective and reliable information.

Risk Management and Exit Strategy

As with any investment, risk management is crucial in cryptocurrency investing. Set clear investment goals and determine your risk tolerance. Avoid investing more than you can afford to lose and establish an exit strategy to protect your gains and minimize losses. Regularly review your portfolio and make adjustments as needed based on market conditions and your financial objectives.

Regulatory Compliance

Complying with applicable regulations is essential for US citizens engaging in cryptocurrency investments. Stay informed about tax obligations related to cryptocurrency gains and consult with a tax professional if needed. Additionally, be aware of any local or federal regulations that may impact your investment activities.

Long-Term vs. Short-Term Investments

Before deciding on your investment horizon, assess your financial goals and risk appetite. Long-term investments are suitable for those seeking potential substantial returns over an extended period, while short-term investments involve more active trading to capitalize on short-lived market opportunities. Align your investment strategy with your financial objectives to achieve the best results.

Top Reliable and Legit Cryptocurrency Investment Websites for Investors

- Coinbase – https://www.coinbase.com/ Coinbase is one of the most reputable and user-friendly cryptocurrency exchange platforms, known for its security features and a wide range of supported cryptocurrencies. It provides a seamless experience for both beginners and experienced investors.

- Binance – https://www.binance.com/ Binance is a popular global cryptocurrency exchange that offers a vast selection of cryptocurrencies for trading and investing. It has a robust trading platform, advanced charting tools, and various security measures.

- Kraken – https://www.kraken.com/ Kraken is a well-established cryptocurrency exchange known for its strong security features and compliance with regulations. It offers a variety of cryptocurrencies and is widely trusted by the crypto community.

- Gemini – https://www.gemini.com/ Gemini is a regulated cryptocurrency exchange in the USA, known for its emphasis on security and compliance. It provides a simple and transparent platform for buying, selling, and storing cryptocurrencies.

- eToro – https://www.etoro.com/ eToro is a social trading platform that allows investors to trade cryptocurrencies and other assets while also following and copying the strategies of experienced traders. It’s ideal for investors seeking a user-friendly and social approach to trading.

- Bitstamp – https://www.bitstamp.net/ Bitstamp is one of the longest-standing cryptocurrency exchanges, offering a reliable and secure platform for trading popular cryptocurrencies. It has a straightforward interface suitable for both beginners and experienced traders.

- KuCoin – https://www.kucoin.com/ KuCoin is a global cryptocurrency exchange known for its wide range of listed cryptocurrencies and competitive trading fees. It also provides various features like staking and lending for additional earning opportunities.

- Bitfinex – https://www.bitfinex.com/ Bitfinex is a well-known cryptocurrency exchange with advanced trading features and a large selection of digital assets. It caters to both individual investors and institutional traders.

- OKEx – https://www.okex.com/ OKEx is a comprehensive cryptocurrency exchange that offers spot trading, futures trading, and a range of other financial products. It has a strong reputation in the industry.

- Huobi – https://www.huobi.com/ Huobi is a global cryptocurrency exchange known for its liquidity and extensive range of supported cryptocurrencies. It provides various trading options and investment products.

Please note that while these websites are reputable and widely used, it’s always essential for investors to exercise caution and conduct their research before investing in cryptocurrencies. Additionally, regulatory compliance and security measures should be carefully considered when using any cryptocurrency exchange or investment platform.

Conclusion

Cryptocurrency investments offer exciting opportunities for US citizens, but they also require careful planning and strategy. Understanding the basics, conducting thorough research, and diversifying your portfolio are essential steps to success. Implementing dollar-cost averaging, prioritizing security, and staying informed about market trends are equally crucial. Remember to manage risk, comply with regulations, and align your investment horizon with your financial goals. By following this comprehensive guide, you can navigate the dynamic world of cryptocurrency investments with confidence and seize the potential for significant financial growth.

Disclaimer for Investors: Warnings and Alerts

Investing in cryptocurrencies carries inherent risks and should be approached with caution. Before proceeding with any cryptocurrency investments, it is essential for investors to carefully read and understand the following disclaimer:

- Volatility Warning: Cryptocurrencies are known for their extreme price volatility. The value of cryptocurrencies can experience rapid fluctuations within short periods, leading to significant gains or losses. Investors should be prepared for the possibility of substantial price swings and exercise prudence when making investment decisions.

- Lack of Regulation: Unlike traditional financial markets, the cryptocurrency industry is relatively less regulated. The absence of a centralized authority may expose investors to potential scams, fraudulent schemes, and market manipulation. It is crucial to conduct thorough research and exercise due diligence before investing in any cryptocurrency project.

- Security Risks: Cryptocurrency investments involve the use of digital wallets and exchanges, which can be susceptible to cyberattacks and hacking attempts. Investors should prioritize the security of their holdings by adopting best practices, such as enabling two-factor authentication (2FA) and using hardware wallets for storage.

- Loss of Capital: Investing in cryptocurrencies carries the risk of losing a significant portion or the entirety of the invested capital. Investors should only invest funds that they can afford to lose without compromising their financial stability.

- Market Speculation: Cryptocurrency markets can be influenced by speculation and market sentiment. Price movements may not always be driven by fundamental factors, making the market inherently unpredictable. Investors should avoid making impulsive decisions based solely on short-term market trends.

- Regulatory Changes: The regulatory landscape for cryptocurrencies is continually evolving. Changes in regulations and government policies can impact the cryptocurrency market and investor sentiment. Investors should stay informed about relevant regulatory developments and assess how they may affect their investments.

- Liquidity Risks: Some cryptocurrencies may suffer from low liquidity, which can result in challenges when buying or selling large amounts of the asset. Illiquid markets may lead to price slippage and difficulties in executing trades at desired prices.

- Market Manipulation: Cryptocurrency markets are susceptible to potential manipulation by large investors or coordinated groups. Such activities can create artificial price movements and distort market conditions.

- Unpredictable Technological Changes: Cryptocurrencies are based on evolving blockchain technology. While some projects may succeed, others may face technical challenges or become obsolete over time. Investors should thoroughly assess the technology and potential use cases of the cryptocurrencies they invest in.

- Consulting Professional Advice: Cryptocurrency investments require careful consideration and expertise. It is recommended that investors seek advice from qualified financial advisors or investment professionals who can offer personalized guidance based on individual financial situations and goals.

Final Note: Investing in cryptocurrencies can be rewarding, but it also comes with significant risks. The cryptocurrency market is still in its early stages, and the future remains uncertain. By understanding and acknowledging the risks involved, investors can make informed decisions and approach cryptocurrency investments responsibly. Each investor should exercise due diligence and act in accordance with their risk tolerance and investment objectives.

Disclaimer for Readers:

The information provided in this article is for educational and informational purposes only. It does not constitute financial advice, and the content should not be considered as a recommendation to invest in cryptocurrencies.

Readers are advised to conduct their research and exercise due diligence before making any investment decisions. The cryptocurrency market is highly volatile and involves substantial risks, including the risk of loss of capital.

We, the authors of this article, and the website hosting this content, are not responsible for any financial losses, damages, or adverse outcomes that may occur as a result of following the information presented herein.

Investing in cryptocurrencies carries inherent risks, and each individual should carefully assess their risk tolerance and financial situation before engaging in any investment activities.

We strongly encourage readers to consult with qualified financial advisors or investment professionals to seek personalized guidance based on their specific circumstances.

By accessing and using this article, you acknowledge and agree to the above disclaimer.